Specialized Financing

Description & Legislation

TIMEFRAMES

It is custom for the contract duration to be between 12 and 60 months, although this duration can be extended.

For maximum mileages, normally, up to:

180.000 Km’s for petrol vehicles;

200.000 Km’s for diesel vehicles.

It is custom for the contract duration to be between 12 and 60 months, although this duration can be extended.

For maximum mileages, normally, up to:

180.000 Km’s for petrol vehicles;

200.000 Km’s for diesel vehicles.

RENTS SCHEME

System: Fixed, early payment or payable in arrears;

Terms: Constant;

Frequency: Monthly.

System: Fixed, early payment or payable in arrears;

Terms: Constant;

Frequency: Monthly.

TAX

CiT and PiT (category B incomes with organized accounting).

The financial amortization component included in the rents paid for the rental of the vehicles, correspondent to the value of the depreciations not accepted as a tax expense is not deductible:

Electric Vehicle – The annual depreciation above € 62.500 is not accepted as an expense;

Plug-In Hybrid – The annual depreciation above € 50.000 is not accepted as an expense ;

Bi-Fuel – The annual depreciation above € 37.500 is not accepted as an expense;

Fossil Fuels – The annual depreciation above € 25.000 is not accepted as an expense;

Hybrid – The annual depreciation above € 25.000 is not accepted as an expense.

At the end of each economic year, a comparison between the financial amortizations included in the Renting rents and the value of the accepted fiscal amortizations should be made, in case the vehicle belongs to the company’s assets (as per Circular nº 24/91, December, 19th).

Regarding Flat Rate Taxation:

CiT and PiT (category B incomes with organized accounting).

The financial amortization component included in the rents paid for the rental of the vehicles, correspondent to the value of the depreciations not accepted as a tax expense is not deductible:

Electric Vehicle – The annual depreciation above € 62.500 is not accepted as an expense;

Plug-In Hybrid – The annual depreciation above € 50.000 is not accepted as an expense ;

Bi-Fuel – The annual depreciation above € 37.500 is not accepted as an expense;

Fossil Fuels – The annual depreciation above € 25.000 is not accepted as an expense;

Hybrid – The annual depreciation above € 25.000 is not accepted as an expense.

At the end of each economic year, a comparison between the financial amortizations included in the Renting rents and the value of the accepted fiscal amortizations should be made, in case the vehicle belongs to the company’s assets (as per Circular nº 24/91, December, 19th).

Regarding Flat Rate Taxation:

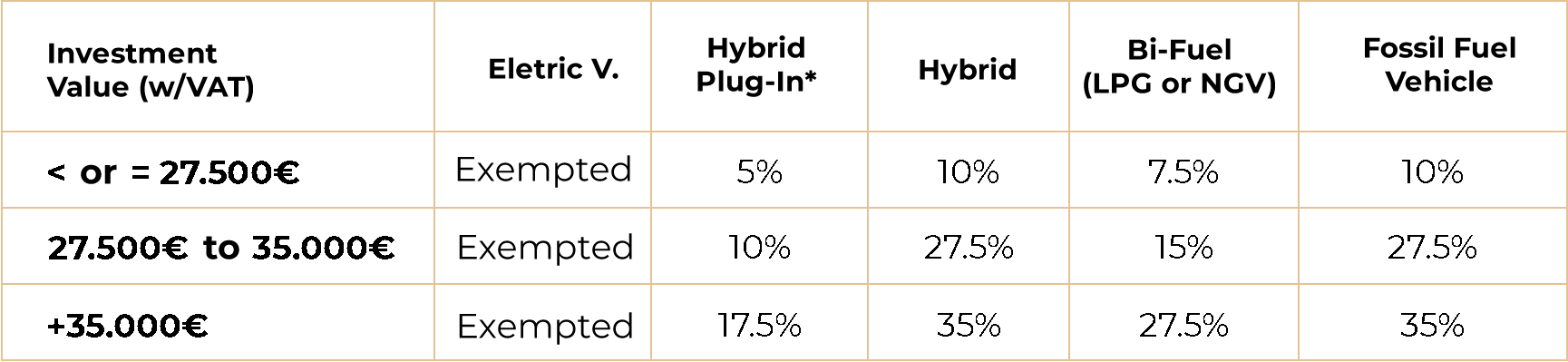

C O M P A N I E S

The expenses related with vehicles will be taxed according to their investment values with the taxes being increased by 10% should the company declare fiscal losses:

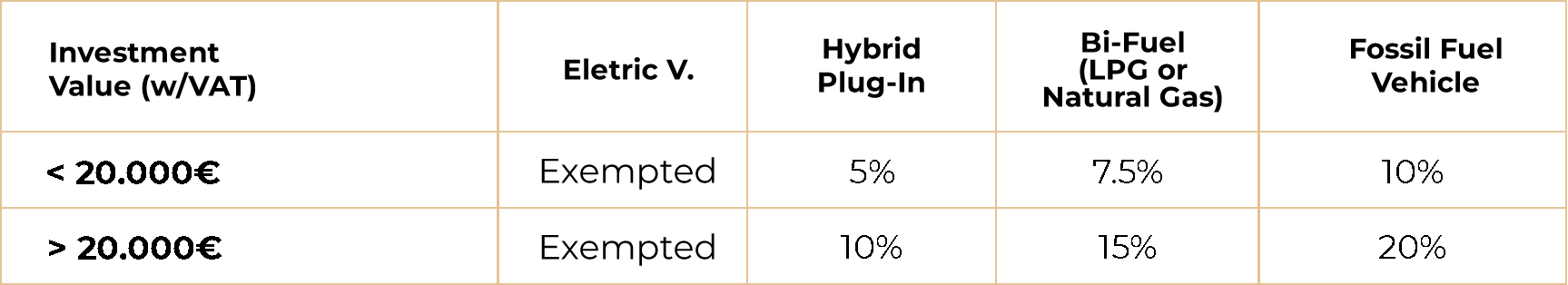

S E L F - E M P L O Y E D

Self-Employed Businessman with organized accounts. The expenses with light passenger or commercial vehicles, motorcycles or motorbikes are taxed:

For the purpose of this tax, expenses related with the vehicles are considered to be reintegrations, rents or rentals, insurance, costs with upkeep and maintenance, fuels and taxes imposed on its use.

V A T

Apply to companies and self-employed businessman. It is possible to deduct the VAT incurred with electrical and hybrid plug-in passenger vehicles, as long as the acquisition cost does not exceed the limits referred to in the Corporate Tax Code (62,500€ for electrical vehicles and 50,000€ for Hybrids Plug-in).

In the case of bi-fuel vehicles, run by LPG or Natural Gas, it is possible to deduct 50% of the VAT incurred in expenses related with those vehicles, as long as the acquisition cost does not exceed the limits referred to in the Corporate Tax Code: 37,500€.

In the case of light commercial vehicles, it is possible to deduct the totality of the rent’s VAT. The amount of 50% of the VAT over diesel is deductible (regardless of the type of the vehicle).

Apply to companies and self-employed businessman. It is possible to deduct the VAT incurred with electrical and hybrid plug-in passenger vehicles, as long as the acquisition cost does not exceed the limits referred to in the Corporate Tax Code (62,500€ for electrical vehicles and 50,000€ for Hybrids Plug-in).

In the case of bi-fuel vehicles, run by LPG or Natural Gas, it is possible to deduct 50% of the VAT incurred in expenses related with those vehicles, as long as the acquisition cost does not exceed the limits referred to in the Corporate Tax Code: 37,500€.

In the case of light commercial vehicles, it is possible to deduct the totality of the rent’s VAT. The amount of 50% of the VAT over diesel is deductible (regardless of the type of the vehicle).

Note: this information is merely indicative and does not substitute consulting the law in force nor consulting professionals to analyze the specificity of each case.